Kenya’s tea export earnings soared to Sh211 billion in 2024, a significant rise from Sh181 billion recorded the previous year.

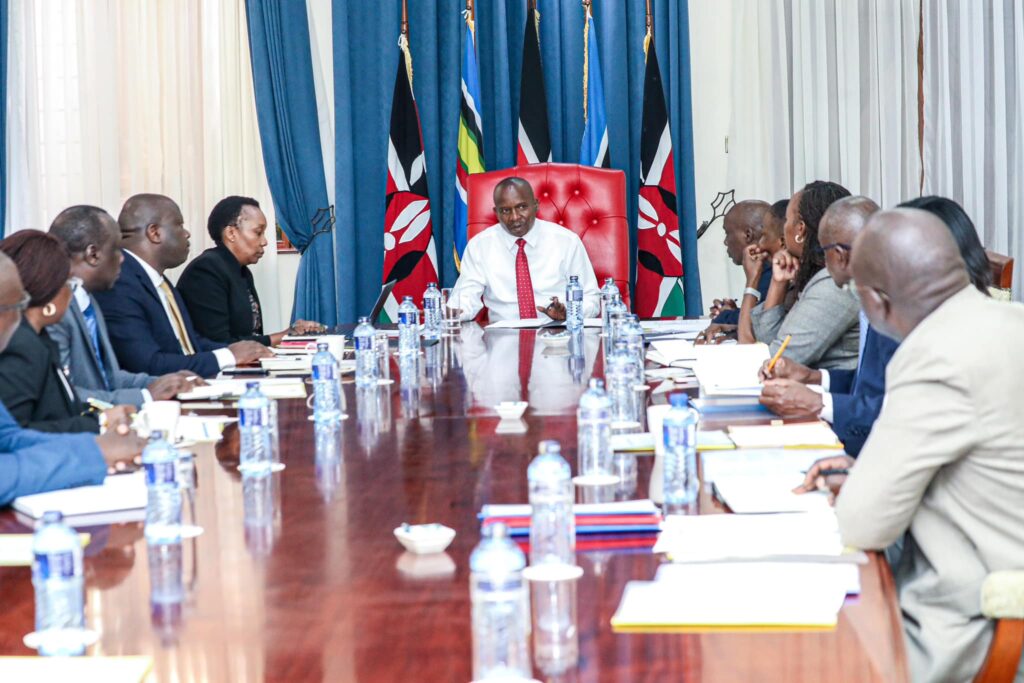

Deputy President Kithure Kindiki made the announcement during a meeting on Tea Sub-Sector Reforms and Market Access for Tea to the Far East and China, held at his official residence in Karen on January 8, 2025.

“The government is supporting tea production through providing subsidised fertiliser, establishment of common user facilities for value addition and exploring new markets,” Kindiki said.

In 2022, Kenya earned Sh445 billion from tea exports.

The DP pointed out that favorable weather conditions, a stronger Kenyan shilling, and enhanced production strategies have all contributed to the sector’s success.

“These measures, favourable weather and a stronger currency- the shilling -has seen tea production increase from 445 million kilos in 2022 to 558 million kilos in 2023 and to 600 million kilos in 2024,” Kindiki added.

Kenya’s tea exports are spread across various international markets, with the main consumers being the UK, Pakistan, Egypt, Sudan, and emerging markets in Asia and Africa.

For several years, Pakistan has remained the largest consumer of Kenyan tea. In 2022, Pakistan accounted for nearly 30% of Kenya’s total tea exports.

Despite facing some challenges in terms of price fluctuations, Pakistan’s demand for Kenyan tea remained resilient.

The UK is another key market for Kenyan tea, particularly for the traditional black tea varieties. It also remains a significant source of Kenya’s value-added tea products, such as tea bags.

Egypt and Sudan, both North African countries, have long been important export markets for Kenyan tea. Egypt’s tea consumption has risen steadily, and the country’s preference for Kenyan tea remains strong.

Countries in the Middle East, including the UAE, have also emerged as significant markets for Kenyan tea. Kenya’s reputation for producing high-quality tea has contributed to increased demand in this region.

Kenya has also been focusing on diversifying its export base by tapping into emerging markets such as South Korea, China, and the United States. These regions are increasingly adopting Kenyan tea due to its premium quality and the rising popularity of specialty teas.

While the growth of Kenya’s tea export industry is impressive, several challenges continue to affect the sector’s long-term sustainability.

Changing weather patterns, including droughts and unpredictable rainfall, have had a negative impact on tea yields in recent years.

This has led to fluctuations in supply, which in turn affects export volumes. The cost of inputs such as fertilizers, labor, and energy has risen, impacting the profitability of tea farming.

Additionally, fluctuations in global fuel prices have affected the cost of transportation and logistics. Kenya’s tea sector faces increasing competition from other tea-producing countries like India, Sri Lanka, and China.

These countries have made significant strides in improving the quality and competitiveness of their tea exports. The volatility in global tea prices, influenced by factors such as supply chain disruptions and geopolitical tensions, can affect the earnings from Kenya’s tea exports.